Target

Assets

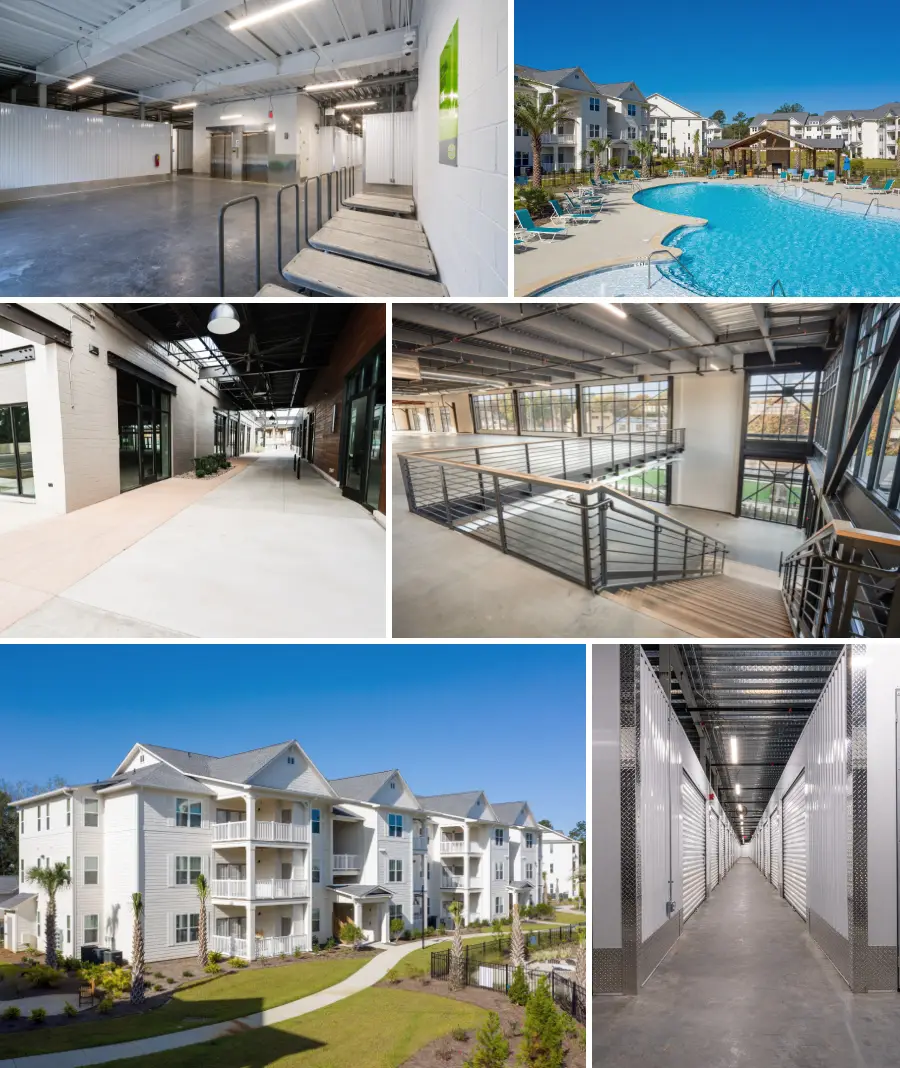

Abacus Capital generally targets high quality or otherwise irreplaceable assets with lower risk profiles where that risk might be mis-priced or otherwise misunderstood.

We strive to identify inefficiencies or dislocations in the real estate capital markets that generate asymmetric return profiles, often characterized by downside protection through attractive going-in bases or current income.

At various points in a market cycle we will typically focus on investing client capital either offensively or defensively.

However, special situations may arise on an episodic basis where we believe a particular offensive investment opportunity may make strategic sense on a risk-adjusted basis in an otherwise defensive investing environment.

We target

niche assets

that can drive

outlier outcomes

niche assets

that can drive

outlier outcomes

Our Strategies

Defensive Asset Investing

- Characterized by income & growth

- Attractive cash flow profile

- Durable in-place income

- Low maintenance capex profile

Read More

- Going-in basis below replacement cost

- Irreplaceable locations

- Infill assets with long term redevelopment/re-use potential

- Growth markets (GDP, population, demographics)

- Attractive supply/demand fundamentals

- Yield premiums not reflective of relative values

- Undercapitalized asset classes or investment strategies

Offensive Asset Investing

- Characterized by capital appreciation

- Development / re-development in undersupplied markets

- Asset enhancement through strategic capital improvements that drive top line growth

- Lease-up of under-occupied buildings to market levels

Read More

- Reposition of existing asset use / positioning amongst its peer set

- Marking in-place rental rates to market levels upon lease rollover

- Front-running transitional micro-markets

- Land development and/or land banking